How the History of Your Vehicle Can Impact Your Car Insurance Premiums

When shopping for car insurance, many people overlook the importance of the history of their vehicle. But believe it or not, your vehicle's history can hugely influence how much you pay for your car insurance premiums. Everything must be considered, from its age and model to mileage and previous accidents, especially when you buy a used vehicle. All these can play a huge role in determining the cost of your policy. Here we will explore how your vehicle's history can impact your car insurance premiums – and what you can do to get the best possible rates.

What to Know Before Buying a Used Vehicle

Before you purchase a used vehicle, it is important to be aware of its history, as it can impact your car insurance premiums. If the vehicle has been in any accidents, this will likely increase your rates. Additionally, if the car has been stolen or vandalized in the past, this can also drive up costs. It is critical to obtain a vehicle history report before making a used car purchase so that you are aware of its background. Ultimately, this information can help you make a more informed decision about whether or not to buy the car and how much insurance to get for it.

Other factors to consider before purchasing a used vehicle include condition, mileage, and maintenance records. You should also check for any recalls issued for the particular make and model of the car. Additionally, you'll want to take it to a mechanic for an inspection before making a final decision. This will help you identify any potential problems with the vehicle so that you can avoid costly repairs down the road.

Always Run a Vehicle History Report

Before Buying a Used Vehicle

Before you buy a used vehicle, it is essential to run a vehicle history report. This report can give you important information about the car, such as whether it has been in an accident or has any outstanding recalls. This information can impact your car insurance premiums, so it's absolutely necessary to have that information. If you can't get it before buying the car, there are ways to get the information after you purchase your vehicle. It's always better to have this information before buying, however, so you'll know whether or not you can afford the insurance.

If you are buying a used car, get a Vehicle History Report (VHR) from a reliable source (like GoodCar). A VHR can tell you if the car has been in an accident, has any open recalls, and more. This information can help you make an informed decision about whether to purchase the car and can also impact your insurance premiums.

If you are looking at a car with a clean VHR, you may be eligible for lower insurance rates. On the other hand, if the VHR shows that the car has been in an accident or has open recalls, your insurance rates may be higher. Either way, it is imperative to have this information before deciding whether to purchase a particular vehicle.

So, make sure you always get a VHR before buying a used car. It'll help ensure that you purchase the right vehicle for your needs and can also keep your insurance premiums low.

Read the Full Vehicle History Report

Before Buying Any Vehicle

If you are considering buying a used car, you need to read the full vehicle history report before making a purchase. The report can provide valuable information about the car's past, including any accidents or damage. This information can impact your car insurance premiums, as insurers often consider a vehicle's history when setting rates.

While the full history report may cost a few dollars, it can save you money in the long run by helping you avoid a car with hidden damage or questionable history. When requesting a report, specify that you want the complete history, as some sellers may only provide partial reports.

In addition to the vehicle history report, you should also take the car for a test drive and have a professional inspect it. This will give you an even better sense of the car's condition before making your final decision.

If you are looking at purchasing a used car with the help of an auto loan, your lender may also request a copy of the full vehicle history report. This is because they will want to know about any outstanding finance on the car or if it has been declared a write-off by an insurer.

Types of Title Brands That May Affect

Your Car Insurance Premiums

The title brand on your vehicle can play a role in how much you pay for car insurance. If your vehicle has a salvage title, finding an insurance company willing to provide coverage may be more difficult. This is because salvage vehicles are typically worth less than their original value and are considered to be at a higher risk for accidents.

If you have a rebuilt title, it means that your vehicle was once a salvage but has been repaired and inspected by the Department of Motor Vehicles. While this may not impact your premium as much as a salvage title would, it is still something to consider when shopping for car insurance.

Other types of title brands that could affect your car insurance premiums include:

- Flood-damaged vehicles: Vehicles damaged by floodwaters can be difficult to insure due to their increased risk of mechanical and electrical issues.

- Fire-damaged vehicles: Vehicles that have gone through a house fire or wildfire will often get a fire-damaged title brand. This lets you know that some of the vehicle's parts were exposed to heat and could be unreliable in the future.

- Salvage or rebuilt parts: If you have a vehicle with any salvaged or rebuilt parts, the insurance company may raise your rates because these parts may be unreliable.

- Lemon law buyback: A lemon law buyback is when a manufacturer takes back a vehicle with numerous defects and repairs it before selling it again. Insurance companies view these types of vehicles as higher risks and will often charge higher premiums.

- Saltwater brand: Vehicles with a saltwater brand were typically exposed to saltwater during a flood. This is common following natural disasters, but it could also have been someone driving along the beach and getting the vehicle stuck. It is important to know about this because the salt could cause a deterioration of the mechanicals of the vehicle.

- Theft recovery vehicles: These vehicles were once stolen but have since been recovered. Insurance companies may consider them riskier and, therefore, more expensive to insure.

- Odometer rollback: If someone has rolled back the odometer on a vehicle, it can be difficult to accurately determine the car's value, so the premium may be higher.

No matter what type of title brand you have, make sure to shop around and compare rates from multiple insurance companies to ensure you are getting the best deal.

Can Major Accidents In the Vehicle's Past Raise

Your Insurance Premiums Now?

When buying a used car that's been in a major accident (or two) in the past, you need to know that you are far more likely to face hefty repairs in the future. Major accidents cause a lot of damage, and that damage can sometimes take time to show up.

Insurers know that if they cover a vehicle that's been in a major accident, they are more likely to have to pay for repairs, roadside assistance, and towing services. This realistic potential will likely cause them to raise rates for that vehicle so they do not lose money from your coverage.

However, it is not always clear how much weight is given to vehicle accidents that occurred in the past. This is because there is no way to know how much the insurance company knows about your vehicle upfront. In some cases, accidents may not impact your rates if repairs were made at the manufacturer or if the dealership certified the automobile following that accident. It all depends on the insurance company's assessment of risk.

If you are concerned that past accidents will impact your car insurance premiums, the best thing to do is to shop around and compare rates from different insurers. The more information you have going into the decision, the better your final decision will likely be.

Are Former Test Vehicles More Expensive to Insure?

If you are driving a newer model car previously used as a test vehicle, you may wonder if your insurance company can charge you more for coverage. The answer is yes; car insurance companies can charge more to cover former test vehicles. This is because test vehicles tend to have more wear and tear than regular production cars and may have been in more accidents or had more claims filed against them. So, if you are driving a former test vehicle, you may want to shop around to ensure you get the best insurance policy.

Will It Cost More to Insure a Former Police Vehicle?

Regarding insurance, former police vehicles may be subject to higher rates due to their increased risk. Insurance companies consider several factors when calculating rates, and the type of vehicle is one of them. Former police vehicles are often equipped with powerful engines and other performance-enhancing features that make them more attractive to car thieves and joyriders.

In addition, these vehicles have often been involved in high-speed pursuits and other stressful situations that can take a toll on their mechanical components. As a result, insurance companies may view them as higher risk and charge higher rates accordingly.

Of course, not all former police vehicles are created equal. Some may have been driven mostly in low-risk areas and well-maintained throughout their service life. In these cases, the increased insurance costs may be offset by the savings on the vehicle's purchase price.

If you are considering buying a former police vehicle, be sure to do your research and compare insurance rates before making your decision.

Should You Avoid Vehicles Without a Clean Title?

It is no secret that the history of your vehicle can impact your car insurance rates. If you are considering purchasing a vehicle with a less-than-clean title, you may want to think twice. Here's why:

A vehicle with a clean title has never been in an accident, has no outstanding liens or finance charges, and has never been reported stolen. On the other hand, vehicles with a salvage title have already been declared total losses by at least one car insurance company, meaning it has been in an accident or stolen and then recovered. A rebuilt salvage title means the car was repaired after being declared a total loss, but it may not meet all safety standards.

Vehicles with salvage titles typically cost less than those with clean titles but also carry more risk. If you are caught driving a vehicle with a salvage title, your insurance company could refuse to pay for any claims you make. And if you are involved in an accident while driving a salvage-titled car, you could be held liable for any damages caused.

Considering all of this, it is usually best to avoid vehicles without clean titles altogether. If you decide to purchase one, be sure to get full coverage insurance, so you are protected in case of an accident or other issues.

Get Yourself a Full Vehicle History Report from GoodCar and Know What You Are Getting Into

As you can see, understanding the history of your vehicle is important when it comes to car insurance. Knowing the value, safety rating, and other factors associated with a make and model can help you find better rates with an insurer that offers coverage tailored to fit your needs. Be sure to shop around for multiple quotes to make sure you are able to get the best premium possible based on your vehicle's history and circumstances.

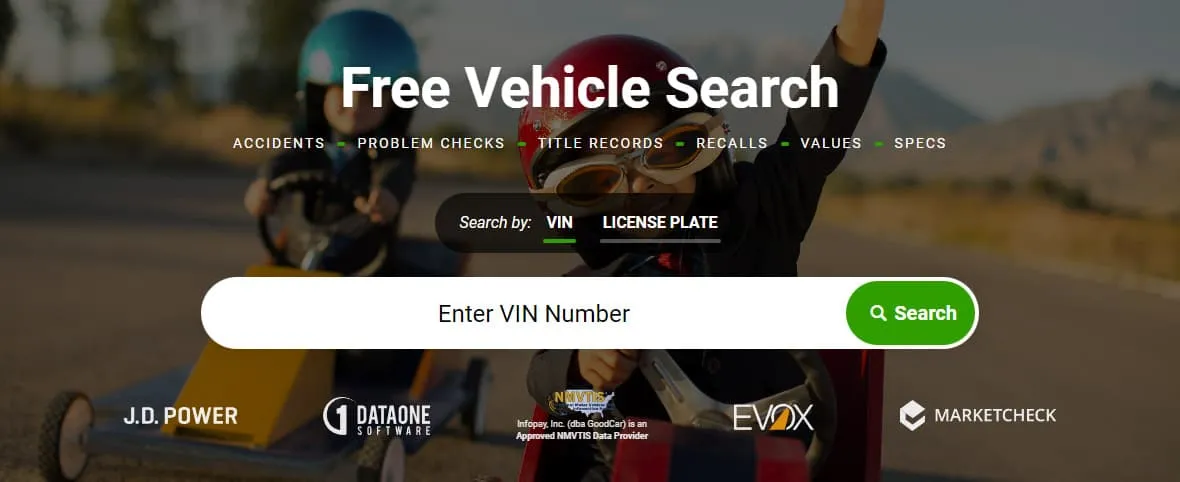

FREE Vehicle Search

- Accidents

- Problem Checks

- Title Records

- Recalls

- Values

- Specs

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-