What Happens When Insurance Totals Your Car

Nobody ever wants to think about the possibility of having their car totaled in an accident. It's a nightmare scenario no one hopes for — but if it does happen to you, understanding what will happen next and your options can help make the situation bearable. You will, of course, have questions like "When does an insurance company total a car"? "When do insurance companies total cars"? What level of damage is a car totaled by insurance companies"? "What is the insurance payout for a totaled car"? Read on to learn about insurance policies and how they can help when your vehicle is declared a total loss.

When Do Insurance Companies Total A Car?

A car insurance total loss is when your vehicle is considered to be a write-off by your insurance company. This can happen if your car is stolen, in some type of accident where the costs of repairs will exceed the value of the car, or if it is damaged beyond repair. If your car is declared a total loss, you will receive a payout from your insurer for the market value for your vehicle at the time it was lost or damaged.

How Does an Insurance Company Decide

if Your Car Is Totaled?

If you're in an accident and your car is damaged, the first thing you'll do is file a claim with your insurance company. Your insurance company will then send out an adjuster to inspect the damage and determine how much it will cost to repair. If the estimated repair cost is more than the actual cash value of your car, your insurance company will declare it a total loss.

Rather than searching the internet asking "how much will insurance pay for my totaled car", you can use an insurance total loss payout calculator to get an idea of what the insurance company may decide is a fair cash value of your car. Each company uses a few different methods to calculate this, including:

- Sales data: The insurance company will look at recent sales of similar cars in your area to get an idea of what your car is worth.

- Estimated replacement cost: The insurance company will also estimate how much it would cost to replace your car with one that's similar in make, model, and features.

- Depreciation: The insurer will also factor in depreciation, which is the decrease in value due to wear and tear over time.

Once the insurance company has calculated the actual cash value of your car, they'll compare that to the estimated repair costs. If the repairs are less than the actual cash value, your car will be repairable. If the estimated repairs are more than the actual cash value, your car will be totaled, and you will get what is commonly referred to as a total loss insurance payout.

What Is A Total Loss Insurance Payout?

A total loss insurance payout is when your insurance company pays you the full value of your car if it is totaled in an accident. This includes paying off any loans you have on the car and giving you a check for the value of the car minus your deductible. If you have gap insurance, this will also cover the difference between what you owe on the car and what it is worth. You can use an insurance total loss payout calculator to get an idea of what you might get, but this oftentimes doesn't take into consideration your local area, as prices and values can change by location.

Who Gets the Insurance Check When a Car Is Totaled?

If your car is totaled in an accident, your insurance company will write you a check for the value of your car. The amount of the check will be based on the actual cash value of your car, minus any deductible you may have. If you have a lien on your vehicle, some insurance companies will issue a check in the name of the lender and the owner of the vehicle, at which point you may be required to endorse the check and submit it to the lender IF it doesn't cover the full cost of the remaining vehicle balance. It's always best to check with your insurance provider to verify who they will issue the check to.

What to Do If You Disagree With the Settlement Offer

If you do not agree with the totaled car insurance payout offer from your insurance company, you have a few options. You can try to negotiate with the insurance company on your own or hire an attorney to help you. If you cannot reach a settlement agreement, you can file a lawsuit against the insurance company.

Understanding GAP Insurance

and How It Could Help If You Have It

If you have a loan or lease on your car, your lender likely requires that you have gap insurance. But even if you don't have a loan or lease, gap insurance can still be a good idea. Here's what you need to know about gap insurance and how it works.

What is gap insurance?

Gap insurance is the optional coverage you can get that helps pay off an auto loan should your car ever get totaled in an accident, and you owe more money on the loan than the car is worth.

Most auto insurance policies will only pay out the actual cash value of your car at the time of the accident. But if you have a loan or lease on your car, chances are you owe more than the car is actually worth. That's where gap insurance comes in. It covers the difference, or "gap", between the money that is still owed on the car and the vehicle's actual cash value.

Tips for Settling an Auto Total Loss Claim

with an Insurance Company

If your car is totaled in an accident, you will need to settle the claim with your insurance company. Here are some tips to help you through the process:

- Gather all of the necessary paperwork: This includes a copy of the police report, estimates for repairs, and any other documentation related to the accident.

- Contact your insurer as soon as possible: They will need to start an investigation into the accident and determine if your car is a total loss.

- Be prepared to negotiate: Your insurance company may not initially offer you enough money to replace your car. It is important to be firm but fair when negotiating a settlement.

- Get multiple quotes for replacement vehicles: This will give you a better idea of how much your car is worth and help you negotiate a fair settlement from your insurance company.

- Don't be afraid to ask for help: If you are having trouble settling your claim, many resources are available to help you through the process.

Alternatives to Selling a Totaled Vehicle

A few different options are available to you if your car is totaled in an accident and you don't want to or can't afford to replace it. One option is to sell the car to a salvage yard. This will give you some money to put towards a new car, but it's important to keep in mind that you won't get nearly as much as you would if you sold the car outright.

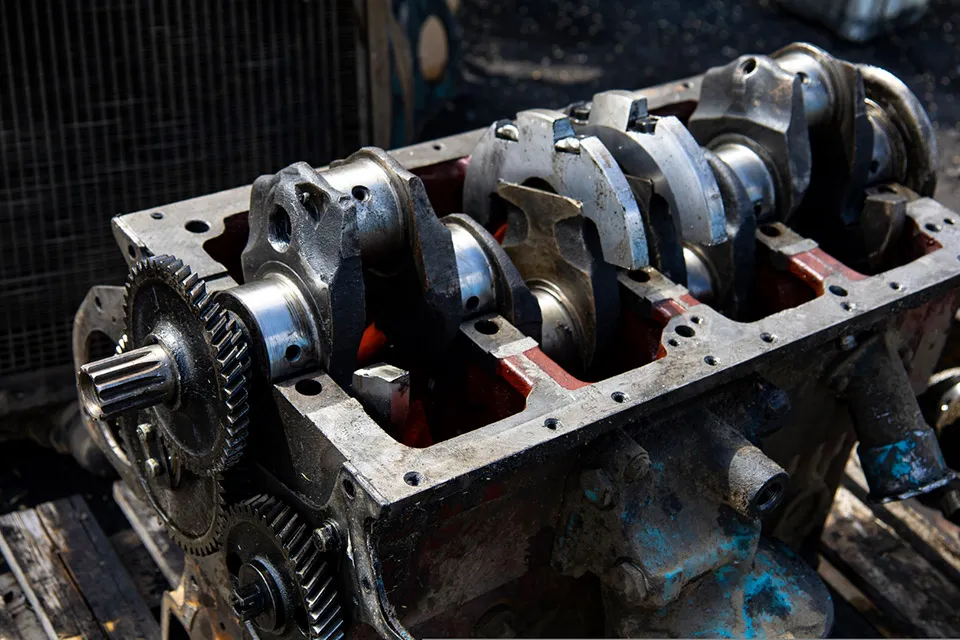

Another option is to keep the car and use it for parts. This is often a good choice if the car isn't too badly damaged and you have some mechanical skills (or know someone who does). You can also try to repair the car yourself, but this isn't recommended unless you are very confident in your abilities and have a good understanding of auto body work.

Finally, you could always donate the car to a charity or non-profit organization. This is a great way to get rid of an unwanted vehicle and simultaneously help out a worthy cause.

There are a few things that you should do if your car is totaled in an accident. The first thing is to call your insurance company and let them know what has happened. You should also get a copy of the police report, so you have all of the necessary documentation. After doing this, you will need to find a replacement vehicle, and we suggest using our Marketplace to find great deals on vehicles in your area! You may be able to get a loaner car from your insurance company while you are looking for a new one with GoodCar.

FREE Vehicle Search

- Accidents

- Problem Checks

- Title Records

- Recalls

- Values

- Specs

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-