Are There Any States That Don't Require Car Insurance?

Wondering which states do not require car insurance? Car insurance is a must for all drivers in most states, so it may come as a surprise to many that there is only one state where car insurance isn't mandatory. Easy — New Hampshire! So today at GoodCar, we'll take an in-depth look at the exceptions in this state and why you should still get car insurance!

What is Car Insurance, and Why is it Important?

Car insurance is a contract between you and an insurance company. Your part of the contract is that you pay your insurance premium, and the insurance company's part of the contract is agreeing to pay for losses as your policy defines them, plus any other coverage you have in your policy. Items like roadside assistance, property damage coverage, and towing are coverage your insurance policy may also provide.

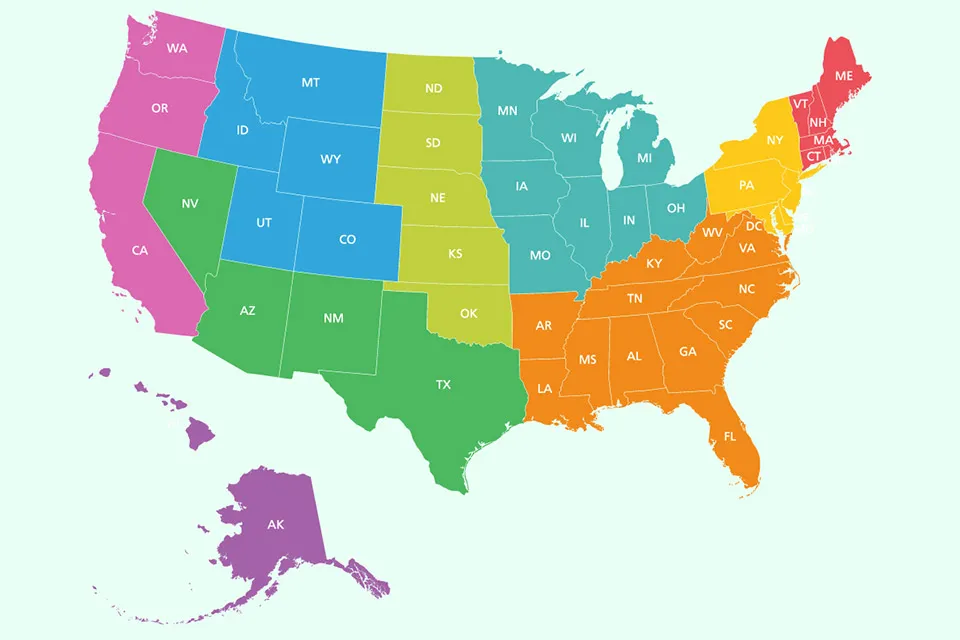

Most states require that you have at least some minimum amount of car insurance coverage. The type and amount of coverage required varies by state, but all states require some form of financial responsibility in case of an accident.

While New Hampshire does not require car insurance, it is still a good idea to have at least some basic coverage. Car insurance protects you financially if you are involved in an accident. It can pay for damage to your car, medical expenses, lost wages, and other costs related to the accident. If you cause an accident, car insurance can also help protect you from being sued by the other driver or their passengers.

Driver Responsibility Laws and What Happens if You Don't Have Car Insurance in Most US States

In most US states, it is illegal to drive without car insurance. If caught driving without insurance, you may be subject to a fine, or your license may be suspended. The fines and suspensions rise with each subsequent time you get caught driving without valid insurance in most of these states, too.

Additionally, some states have adopted driver responsibility laws, which impose additional penalties on those caught repeatedly driving without car insurance. For example, a driver might be subject to community service hours, higher insurance premiums, and license/registration suspensions.

The exact penalties that apply to drivers who don't have car insurance vary from state to state, so it is important to check your local regulations.

New Hampshire – The Only State that Does Not Require Car Insurance

So, what state does not require car insurance? New Hampshire is the only state that does not require car insurance. This means that drivers in this state are not required to purchase or maintain car insurance in order to operate a vehicle. While this may seem like a good deal for drivers in these states, there are some downfalls to not having car insurance.

The financial risk involved is the most obvious downside to not having car insurance. If you are involved in an accident and do not have insurance, you will be responsible for all the damages. This can include repairs to your vehicle, as well as any damage you may have caused to another person's property. In some cases, you may also be responsible for any medical bills incurred by yourself or others involved in the accident.

Another downside to not having car insurance is the increased risk of being sued. If you cause an accident without insurance, the other party may sue you to recover damages. The legal fees can be expensive and time-consuming even if you win the lawsuit.

Overall, it is generally advisable to have car insurance even if it's not required by law. The financial and legal risks of driving without insurance far outweigh the savings from not purchasing a policy.

Statistics for Uninsured Motorists in New Hampshire

According to Bankrate, a mere 13 percent of drivers in New Hampshire were uninsured in 2012, which has dropped to just over 6% since 2019. This is higher than the national average of 12.6 percent. The number of uninsured motorists currently costs insured drivers somewhere in the neighborhood of 13 million dollars annually.

There are many reasons why a driver may be uninsured. Some people cannot afford car insurance, while others may choose to take the risk of driving without coverage. Drivers who have had their license suspended or revoked may also be unable to obtain insurance.

Uninsured motorists put themselves and others at risk every time they get behind the wheel. If they cause an accident, they will likely be sued by the other driver(s). Even if they are not at fault, they could end up owing thousands of dollars in medical bills and property damage costs.

While New Hampshire allows you to drive without insurance if you have the financial means to pay for the effects of an accident, it still does not make it a good idea. Following an auto accident, the lasting effects can be catastrophic.

Benefits of Having Car Insurance

There are plenty of benefits to having car insurance. For one, it can help protect you financially if you're involved in an accident. If the accident is your fault, your insurance company may have to pay for the other driver's damages, which could be expensive.

Insurance can also help cover your damages if you're in an accident that wasn't your fault. In addition, most states require you to have car insurance to drive legally. So, if you don't have it and get pulled over or involved in an accident, you could face serious penalties.

Overall, having car insurance provides peace of mind and financial protection in case of an accident. It's important to shop around and compare rates before buying a policy to ensure you're getting the best deal possible.

GoodCar Recommends You Keep Your Vehicle Investment Insured

At GoodCar, we highly encourage all drivers to carry auto insurance. Even if you happen to be in the only state that does not require you to have full automotive insurance coverage, it is still a good idea. It's the law and could save you a lot of money and hassle in the long run.

FREE Vehicle Search

- Accidents

- Problem Checks

- Title Records

- Recalls

- Values

- Specs

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-