Single-vehicle accidents are more common than you might think and can be just as dangerous as multi-car crashes. According to recent statistics from the National Highway Traffic Safety Administration (NHTSA), single-vehicle crashes accounted for an overwhelming 55% of all fatal motor vehicle accidents in the U.S. (2022).

In the wake of such an event, the relevance of knowing how to handle the situation can make a big difference. From checking your immediate well-being to properly documenting the scene, each step matters in navigating the post-accident process smoothly. Otherwise, your safety, legal standing, and the outcome of any insurance claims may all be at stake.

As you continue reading, you will gain a deeper understanding of what constitutes a single-vehicle accident, including its common causes and liability considerations. This discussion will also cover strategies to minimize complications, such as potential increases in your insurance premiums.

What Is a Single Vehicle Accident?

A single-vehicle accident happens when just one vehicle is involved in a collision or incident. Such incidents can range from minor scrapes to serious crashes, often resulting in damage to your car, nearby property, or injuries to you and your passengers.

Common scenarios include:

- Veering off the road

- Colliding with stationary objects like trees or guardrails

- Vehicle rollovers

- Skidding on a wet road and hitting a lamppost

What Are The Causes of Single-Vehicle Accidents?

The NHTSA provides ample insights into the factors contributing to vehicle crashes, including a single car accident. The NHTSA's National Motor Vehicle Crash Causation Survey (NMVCCS) shows that 94% of motor vehicle accidents are caused by driver-related factors.

Here are the common causes of a single car accident and their approximate percentages:

- Driver Error (65%): This includes mistakes such as misjudging speed, overcorrecting, or losing control due to fatigue, overconfidence, or inexperience.

- Environmental Factors (15%): Poor weather conditions, such as rain or snow, can reduce visibility and road tractions.

- Distractions (8%): Mobile phones and other in-car distractions divert attention from the road, which increases the likelihood of accidents.

- Vehicle Issues (5%): While less common, mechanical problems such as brake failures or tire blowouts can lead to sudden loss of control.

- Impairment (4%): Driving under the influence (DUI) and certain medications can severely impact driving abilities.

- Unexpected Obstacles (3%): Debris, construction zones, or sudden road changes can catch drivers off guard and cause a single-car accident.

Who Is Liable in a Single-Vehicle Accident?

In most cases, if you are involved in a single-car accident, you will likely be considered at fault. However, there are exceptions where you might not be held liable. These situations depend on the specific circumstances and how your insurance company assesses the incident.

You might not be held liable in a single-vehicle accident if:

- You had to swerve to avoid a dangerously driving vehicle.

- An unsecured cargo from another vehicle falls onto yours.

- A pedestrian or cyclist behaves recklessly, contributing to the accident.

- Your vehicle experiences technical or mechanical faults due to a manufacturing defect.

- You collide with animals, such as hitting a deer or a cow.

However, in certain situations —such as severe weather conditions like heavy rain or snow—you may still be held partially responsible if you fail to take necessary precautions. For instance, if you fail to use your fog lights in low visibility, you could be deemed at fault, even if the weather caused the single-vehicle accident.

What To Do After a Single-Car Accident?

If you were unfortunate enough to be the cause or involved in a single-vehicle crash, knowing how to respond immediately after one is imperative for your well-being and legal protection. Taking the right measures can help you manage the situation effectively.

Here are the key actions you should take care of:

- Ensure Safety: Assess your condition and that of any passengers for injuries. If it's safe to do so, relocate your vehicle to a secure area away from traffic and potential hazards.

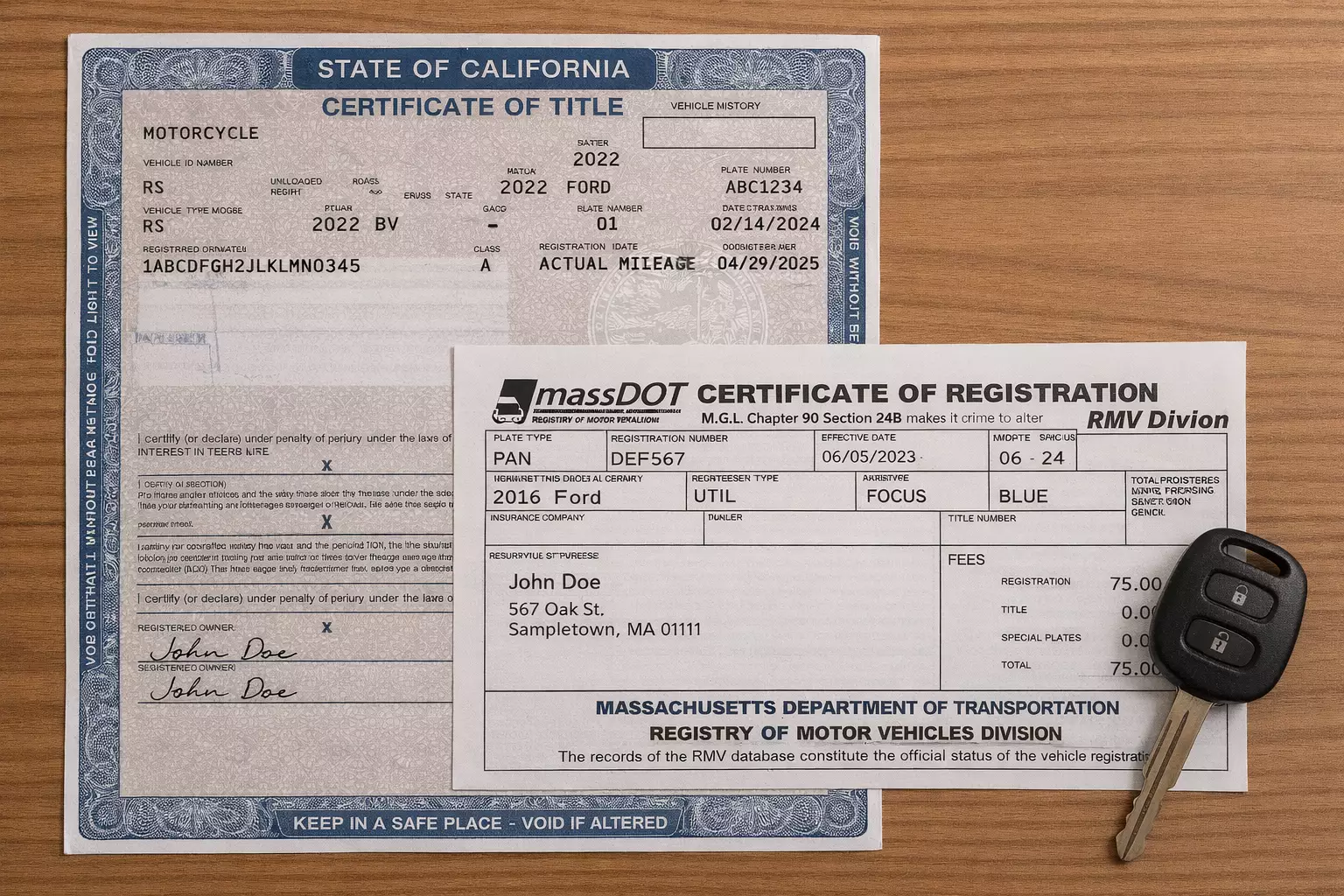

- Call for Help: If necessary, contact the emergency services hotline and wait for the police to arrive. Provide necessary details such as your driver's license and insurance information. Request a copy of the police report for your insurance claim.

- Document the Scene: Capture clear photos of the single-vehicle crash damage, the accident location, and any road conditions that may have contributed. This visual evidence is crucial for supporting your insurance claim.

- Exchange Information: If a property was damaged (e.g., a fence or parked car), leave your contact information or find the property owner.

- Report to Insurance: Inform your insurance company about the accident by submitting a formal request for compensation.

- Gather Evidence: Look for witnesses and get their contact information. Check for nearby security cameras that might have captured the incident.

- Inspect for Hazards: Note any road hazards or mechanical issues that may have contributed to the accident.

- Seek Legal Advice: Consider consulting an attorney, especially if there are questions about liability or potential compensation.

What Happens If You Crash Your Car and Leave It?

Generally, “leaving the scene of an accident, no one else involved” is a serious matter. Many drivers might not realize that such an event without fulfilling legal obligations can still be classified as a hit-and-run and may lead to severe consequences.

Regardless of whether you are directly involved in a single-vehicle crash or witness one, you have specific legal duties such as:

- Stopping at the scene

- Assessing for injuries or damage

- Exchanging information with other parties (if applicable)

- Providing medical assistance if needed

- Notifying the police

For instance, in Nevada, these obligations are explicitly outlined in the Nevada Revised Statutes (NRS) Chapter 484E, which points out the necessity of accident reporting. Failing to do so constitutes you to a hit-and-run that may result in misdemeanor or felony charges, with penalties including fines up to $20,000 and potential jail time.

Additionally, victims may pursue civil damages for medical costs, lost wages, and property damage, along with possible punitive damages against the offender.

Does a Single Car Accident Raise Your Insurance?

If you’re wondering whether a single-vehicle accident will raise your insurance rates, the answer is yes. It can lead to an increase in your premiums, even if no other vehicles are involved.

Frequently, insurers automatically consider the driver at fault in a single-vehicle accident. Since these incidents often stem from preventable factors, insurance companies may raise your premiums.

When you file a claim, the insurer reassesses your risk profile and then categorizes you as a higher risk after a single-vehicle crash, which can result in increased rates.

Factors Influencing Premium Increases

After a single-vehicle accident, it's natural to worry about how your insurance premiums might be affected. Understanding the factors that influence premium increases can help you assess potential rate changes.

Here are the key factors to consider:

- Severity of the Accident: More extensive damage and higher repair costs usually lead to steeper increases.

- Driving History: A clean driving record helps you maintain lower premiums, while a history of claims can drive your rates up.

- Policy Features: Some policies offer accident forgiveness, which will protect you from rate increases.

- State Regulations: State regulations on rate adjustments vary. For instance, California banned rate hikes for not-at-fault accidents, while New York requires insurer approval for rate changes.

- Insurer Practices: Insurers use varied practices for rate adjustments in post-accident, such as offering a "diminishing deductible" that reduces over time without claims.

Preventing Rate Increases

To help prevent rate increases after a single-vehicle accident, focus on improving your driving habits. By practicing safe driving, you can reduce future risks and potentially lower your premiums.

Additionally, shop for auto insurance that offers comprehensive coverage or benefits like roadside assistance and accident forgiveness, which can help save you money in the long run.