Why Is It Suspicious To Buy A Car With Cash?

For those in tip-heavy businesses like bartending or serving, it makes sense to have a higher number of transactions taking place all in cash. But when it comes to buying a car, using cash can raise red flags; paper money is harder to trace, easier to counterfeit, and easier to steal than a credit or debit card. That being said, it's still legal tender. So what's the problem with paying for a car in cash?

Why Dealerships Don't Want You To Pay In Cash

Part of the reason a dealer may turn his nose up at cash is profit. It seems counterintuitive, but dealerships can make far more money if you don't pay for a car entirely in cash up front. Vehicle financing, while not offering the lump sum of an outright car purchase, can get dealers a higher level of profit over time. Lenders may also incentivise dealerships to encourage financing options by offering them a small percentage.

There are two forms of vehicle financing: loans and leases.

What is a Car Loan?

A car loan involves going through a lender to finance your car, with an interest rate set based on your credit score. You'll make monthly payments to this lender until the principal, or the outright purchase value of the car, is paid. These payments will include that interest rate, so you'll end up paying a bit more than the car's value by the end. This extra cost is usually worth it though, as it helps soften the blow of making such a major purchase. You'll get to drive the car during your loan period like it's yours anyway, and once the loan is paid off, the vehicle will legally be in your possession.

What is a Car Lease?

A car lease is similar to a car loan, but with the dealership usually being the entity lending you the capital. You'll get an interest rate just like you would with a car loan, and a set term limit within which you'll lease the car. This allows you to drive a vehicle for a couple of years, and if you don't like it, you can switch it out for something new. Much like with car loans, this is a good option for someone with a more limited budget who still wants a high-quality vehicle.

How Can I Calculate Lease or Loan Payments?

If you decide to lease or finance a car instead of purchasing one outright with cash, you can calculate your payments using free tools like the one from GoodCar. This calculator is essential for those who are operating on a budget and want to see which vehicles will fit with their income. Getting this information ahead of time can help you determine what features you can have on your vehicle, what mileage range you should shoot for, and what terms you should set for your lease or loan. Calculating your payments ahead of time can also assist you with negotiations; if you know what your limit is, you'll be able to discuss that budget with your dealer and try to come to an agreement that works for all parties.

Why You Should Never Pay Cash for a Car

There are a few very reasonable causes for a dealership to refuse a cash deal. Yes, cash is legal tender, and you should be able to purchase a vehicle using entirely paper currency. Unfortunately, most areas give private businesses the right to refuse service for any reason, and a dealership may deem your big pile of cash too sketchy to accept. So why would they do this? There are three primary reasons that cash is a bit more suspicious:

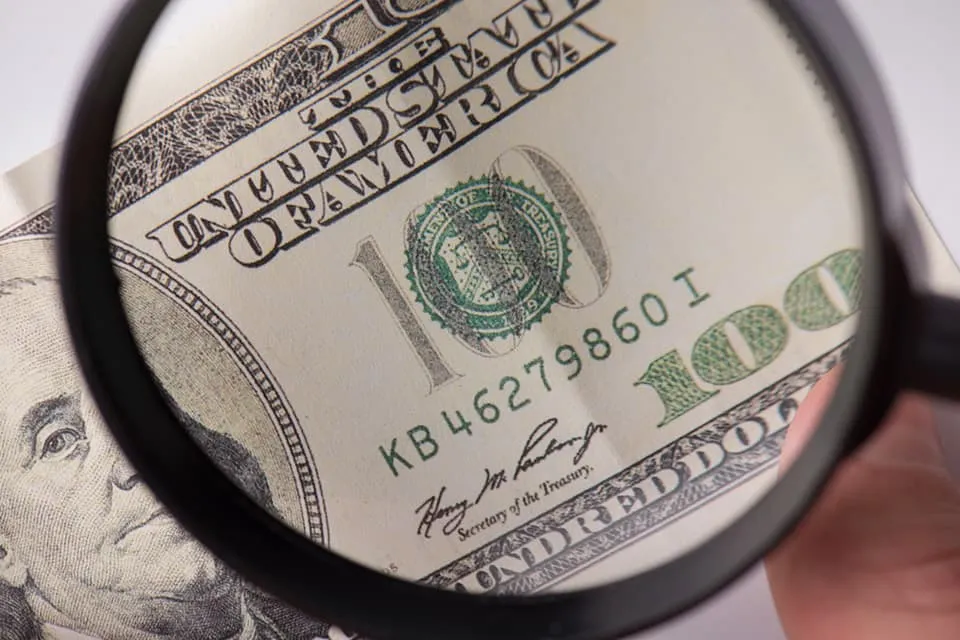

Cash is Easier to Fake

While creating a fake credit card that you could actually use is nearly impossible, the world is filled with counterfeit paper currency. Outside of a bank, many forms of fake currency go entirely unnoticed; without the trained eye of an expert, you are likely to miss the subtle clues that help identify fake cash. A dealership knows this, making them apprehensive to accept a duffel bag full of crisp hundred dollar bills. Tracking down someone who has provided fake money and false information would be difficult, and most dealers would rather just use a more reliable form of transaction like credit.

Cash is Often Used By Criminals

Due to the far lower traceability of cash, it's no wonder that it is the primary form of transaction used by criminal organizations. Of course, everyone who uses cash isn't a criminal; authentic paper currency is legal tender, and almost every citizen of a country will have to use cash from time to time. But for criminals, using cash allows them to profit from illegal activities while hiding their revenue from law enforcement and the IRS Purchasing a vehicle with cash could be a great way to offload ill-gotten gains, and turn them into a legitimate purchase with verifiable paperwork.

Cash is Easily Stolen

Outside of specially marked bills like those in certain banks and reserves, there is almost no way to tell when a single piece of paper currency has been stolen. That's why, for the most part, no one leaves a majority of their net worth in actual cash anymore. Anyone who finds your paper currency can take it and claim it as their own, and it would be next to impossible to prove that it was yours. Dealerships know this, and in addition to the need to avoid accepting stolen cash as payment, they don't want to have a large pile of paper currency just sitting around. This could make them a target for theft, forcing them to have a higher level of security to keep the cash safe.

Buying a Car with Cash Frequently Asked Questions

What Happens if You Buy a Car with Cash?

Trying to buy a car with cash may lead the dealership to refuse your sale, as cash is a form of payment that can make some business owners uncomfortable. If they do accept your cash, you'll pay in the same form you would for any other outright vehicle purchase. You won't have any monthly payments or interest as you would with a lease or loan, but you will need to pay a rather large sum right away.

How Much Cash Can You Deposit Without Raising Suspicion?

According to the Bank Secrecy Act, any bank or financial institution complying with federal law is required to report cash deposits exceeding $10,000. This means if you are trying to deposit money without raising suspicion, like many criminal organizations intend to do, then your deposits would have to be in amounts lower than $10,000. This isn't a guarantee that your cash deposits won't be reported to the IRS or raise suspicion, and you should never deposit money that has been acquired illegally or isn't under your ownership.

Does the IRS Know if You Buy a Car with Cash?

Yes, the IRS will know that you purchased a car, even if you purchase it entirely with cash. Vehicle dealerships are required to fill out a tax form called Form 8300, also known as a Report of Cash Payments Over $10,000 Received in a Trade or Business. If a business is complying with the law they will submit this form within 15 days of you making your cash payment. This has to be down for all cash payments over $10,000. The only way the IRS would not know is if the dealership did not submit this paperwork and you failed to notify them of your transaction or ownership.

Is it Smart to Pay Cash for a Car?

While paying cash for a car can save you on interest and payments, most dealerships will prefer any other form of payment. You can also get more accessories and extras with a financing plan, as many dealerships will roll those into your terms instead of charging you outright. If cash is the only way you can pay for a car, and the dealer will accept it as a form of payment, then it may be the best decision for you. But if there is any other way you can pay, it's usually a better choice to go with a method that dealerships are more comfortable with.

What is One Disadvantage if You Buy a Car with Cash Instead of Getting a Loan?

The biggest disadvantage when you purchase a vehicle with cash is the size of the transaction. Even if the vehicle you purchase is used, you are still likely to pay thousands, or tens of thousands, of dollars. For many this could mean draining savings or investment accounts, and leaving less money over for essentials like rent, food, gas, and utilities. If you have the available capital to buy a car with cash, you are more than welcome to do so. But if you operate on a budget or have concerns about spending so much money at once, a financing plan can give you a way to acquire reliable transportation for a reasonable monthly payment.

FREE Vehicle Search

- Accidents

- Problem Checks

- Title Records

- Recalls

- Values

- Specs

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-