What Are Possible Red Flags or Signs Of a Scam When Buying a Car?

While buying a car has never been easier, it’s also never been more common to fall prey to used car scams. The National Highway Traffic Safety Administration estimates for odometer fraud alone, nearly 450,000 vehicles are sold each year with falsified odometer readings, costing car buyers in the U.S. more than $1 billion in damages each year. With the prevalence of all car-buying scams rising, you as a consumer need to know what to look for and the best way to purchase a car safely.

4 Common Car Buying Scams

Used car scams are unfortunately common and can lead to significant financial losses. Here are four common car buying scams you should watch out for to ensure a safe and smart purchase.

Scam #1: Odometer Rollback

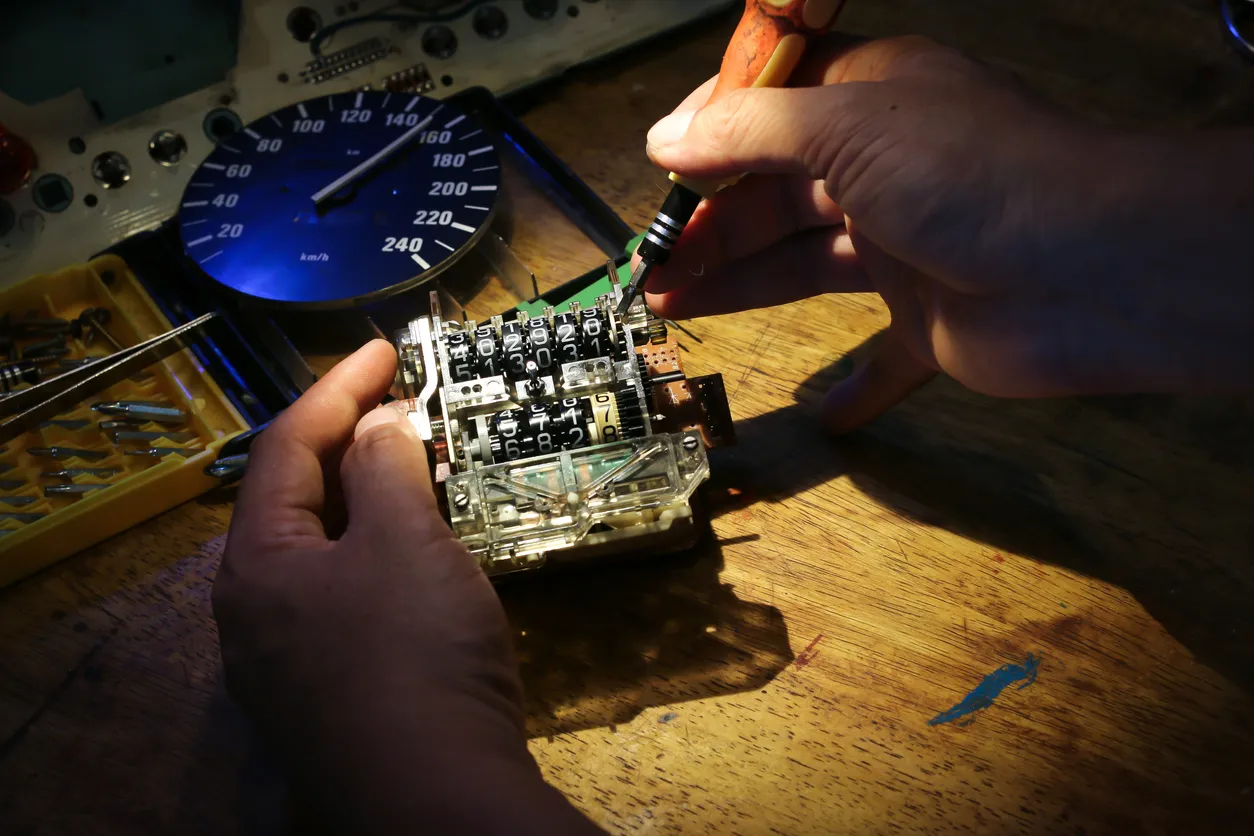

Odometer rollback, or odometer fraud is a major red flag when buying a used car and remains a persistent in the car-buying market. The National Highway Traffic Safety Administration (NHTSA) has an entire office dedicated to this scam alone. Odometer rollback involves the falsification of a vehicle's mileage, either by tampering with the digital readout or manually manipulating the mechanical odometer. Once the mileage is reduced, scammers sell the vehicle and falsify paperwork to make the car look in far better condition than it really is.

Odometer rollback can be dangerous; not only can a vehicle with a fake mileage break down and cost you thousands in repairs, but these mechanical failures can happen anytime. Failing components can cause accidents or leave you stranded in areas that are not easily accessible to emergency or recovery teams.

How to Avoid an Odometer Rollback Scam

According to the NHTSA, there are a few ways you can avoid this type of used car scam:

- Get a Vehicle History Report: A vehicle history report can be an invaluable resource for information about any available car, including mileage, accident history, previous repairs, and the number of prior owners. If the mileage on your report does not match the number provided by your seller, they may be trying to commit odometer fraud.

- Ask for the Title: One of the most vital documents in any car-buying situation is the vehicle title; in addition to the VIN number, make, model, year, and essential technical information, a car’s title will contain its last recorded mileage. If this number is higher than the mileage being told to you by a seller, that is a massive red flag of a car buying scam that may be taking place.

- Check the Inspection Records: Maintenance and inspection records can be revealed by a simple car vin check that will also have the vehicle's last recorded mileage, making them a great way to check for odometer fraud. In addition, look for oil change stickers that many automotive maintenance shops will put on the inside of a car's window, under its hood, or in its glove box. A careless scammer might overlook these stickers,which display the vehicle's last known mileage - a crucial detail when checking for a used car scam.

- Observe Visible Wear and Tear: One thing that can give away a fake mileage number is the level of wear and tear you observe on the vehicle. If a car is reported as having less than 30,000 miles, but you can see wear on the pedals and seats or observe apparent deficiencies during a test drive, it’s best to find the actual mileage through whatever means possible.

- Look at the Tires: Another clear indicator of high mileage is the wear on the tires. If you are told that the car has less than 20,000 miles, it likely will still have its original tires. If you see they’ve been replaced, or the tires the car has had very low tread depth, it’s likely the seller is attempting to commit odometer fraud.

Scam #2: Vehicle Wire Fraud

One car buying scam that the FBI has been warning buyers about since 2011 is vehicle wire fraud. For vehicle wire fraud, scammers will ask for a wire transfer to pay for a used car. The websites these cars are sold on will appear legitimate and often include vehicle specifications, contact information for the seller, and other details meant to put the buyer at ease. The vehicles will also usually be sold at a price below their current market value to entice you to send a wire transfer quickly.

Wire transfers are a non-physical way to send money from a bank or other financial institution using an account number and a supposedly secure system. However, these transfers are nearly impossible to reverse, making them a prime target for car buying scams. Once the money is wired, scammers can easily retrieve their ill-gotten gains from any institution’s locations, leaving you with little chance of recovering your funds or identifying who received the money.

How to Avoid Wire Fraud

According to the Federal Trade Commission, here are some ways to avoid falling prey to this car buying scam:

- If Possible, Avoid Wire Transfers Entirely: While wiring money is a speedy way to transfer funds quickly and legitimate companies, like Western Union and Moneygram, do exist, you should try to avoid wire transfers for transactions if you can. There are far more reliable ways to pay someone for goods and services, like a credit card, that have much better protection against fraud.

- Never Wire Money to Someone You Haven’t Met: Because the chances of getting your money back are low and identifying the recipient is difficult, make sure you trust anyone receiving a wire transfer. If you don’t personally know the vehicle seller and haven’t met them in person, it’s relatively likely that you won’t receive the car at all, which is a common tactic in a used car scam. If you must wire money, make sure to have extensive contact information, meet the buyer beforehand, and see the car in person before sending the cash.

- Watch for Impersonators: One common facet of this type of used car scam is impersonating a person of authority. A vehicle scammer may claim they are a high-level member of an automotive organization or represent a prominent brand name like Ford or Toyota. This is meant to put you at ease and give more weight to their excuses for why a wire transfer is an acceptable form of payment. Ask for credentials proving the seller's identity, and if they refuse to provide any form of identification, avoid buying from them.

- “We Only Accept Wire Transfer” is a Red Flag: Another warning sign of a used car scam is when the seller insists that a wire transfer is the only way they can pay. They will put immense pressure on you to use this form of payment and say that you should send the money as soon as possible. There is almost no reason why a wire payment would be the only acceptable way to pay for a vehicle; if a seller says it is, look for a car elsewhere.

Scam #3: Hiding Flood Damage

One common car buying scam you'll see after flooding or hurricanes is the sale of flood-damaged cars. A flood-damaged vehicle has been partially or wholly submerged in salt or freshwater; the internal components in these vehicles, including the body, engine, and transmission, will undoubtedly be damaged. Flood-damaged vehicles can have a distinct foul odor, significant rust, noises, smoke upon starting the engine, and completely non-functioning electrical components. Scammers will do what they can to clean up the vehicles to hide any signs of damage, turning a used car scam into a situation where the car is sold for a far higher price than it's worth. Once purchased, these cars will cost more in repairs than they are worth; buying a flood-damaged car is a costly mistake you should avoid at all costs.

How Can You Spot a Flood-Damaged Vehicle

According to the Federal Trade Commission, here are some ways to avoid buying a flood-damaged car and falling victim to this type of used car scam:

- Look for Signs and Smells: The smell of a vehicle can be a dead giveaway for flood damage due to a common effect of prolonged water exposure: mold. Even if the scammers peel back every floor mat and carefully scrub each surface, a “musty” smell will likely permeate the vehicle’s cabin. You can also look for visible signs of mold, mud, or leftover sand from an incomplete cleaning. Carpet replacements can be one of the red flags when buying a used car; if you see mismatched colors, the scammer likely hastily bought whatever they could to replace the moldy interior.

- Check the NICB Database: The National Insurance Crime Bureau, or NCIB, has a free database that will give you several details about a car, including whether it’s been flood-damaged. In addition, you can find whether the car was declared salvaged or stolen but not recovered; this information is only available if the car was insured when this damage occurred.

- Get the Vehicle Inspected: Some scammers will go all out to clean a car and remove any signs of flood damage, so it may be difficult to notice the subtle signs with the naked eye. If possible, you'll want to take a car to an automotive technician to get inspected. A professional mechanic can find even the slightest signs of water damage, helping identify issues before they turn into catastrophic mechanical failure.

- Get a Vehicle History Report: Like odometer rollback, flood-damaged cars can be easily identified with a vehicle history report. One of the main features of these reports is information about a vehicle’s title status. If the car’s seller says the vehicle has a clean title, but your report shows it’s been given a flood-damaged brand,this is a clear sign of a used car scam and you can back out of the deal before anything is finalized.

Scam #4: Curbstoning

Curbstoning is a more extreme version of the lemon car scam, in which an unscrupulous seller puts together a car from a salvage yard, auction, or, as the name suggests, one that is simply on the curb. These scammers will primarily focus on the car's exterior, offering the vehicles at an incredibly low price to unload them quickly. A classic used car scam, known as curbstoning, involves sellers who have no license, permits, insurance, or address for their supposed business. Curbstoners will often advertise in classified ads, on marketplaces, or through social media to bring in victims. Even if they have a sham website or some type of contact information, these forms of communication will almost certainly dry up once the sale has been made.

How to Avoid Curbstoning

According to the Tennessee State Government, here are some ways you can protect yourself from this type of car buying scam:

- Make Sure You Know the Seller: Much like with wire transfer fraud, it’s best to know the person before you send them any money. While it’s never good to neglect research when buying a car, it may be understandable if the seller is a close personal friend or a family member. If the seller is a stranger, you have no reason to trust them and should do as much verification as possible before finalizing a purchase.

- Know the Vehicle’s History: It’s best to find out all you can about a vehicle’s history before purchasing, either with a VIN decoder or a vehicle history report. These tools will allow you to print out the information you can bring to a meetup; if the seller's claims don't match what you find in your reports, you can cross-check the information and catch them before sending any payment.

- Purchase Certified Pre-owned Vehicles: One easy way to avoid curbstoning is to find vehicles that are certified by a dealership. Even if you are buying through a dealership, some unethical dealers will use a form of curbstoning to get rid of damaged or previously salvaged vehicles. With a certified pre-owned vehicle, you (usually) have a guarantee by a manufacturer or dealership that a car has met certain criteria.

- Check the Paperwork: Many curbstoners won't have all the paperwork necessary to verify the condition of a car, especially a title. This is a common sign of a used car scam. You should never purchase a car with no title, as these may be stolen, heavily damaged, or no longer street-legal.

Scam #5: Title Washing

A car’s title can tell you a lot about the vehicle’s condition, and in most cases, you’ll want to make sure the car you purchase has a clean title and brand. Unfortunately, because vehicles with clean titles have the most value, unscrupulous sellers will do whatever they can to acquire them. This leads to a title washing scam, where the owner will illegally or semi-legally get a clean title for a previously damaged vehicle.

These scammers will primarily get a clean title by taking a salvage vehicle and repairing it. Most of the time, they’ll only repair the car enough to pass for mechanically functional. Once the vehicle is “fixed,” they’ll drive it out of state to a place with laxer titling laws and get that valuable clean title. This tactic is a common red flag when buying a used car, as a title-washed vehicle is likely to break down soon after purchase, leading to costly repairs or leaving you stranded.

How to Avoid Title Washing

- Check a Car’s Title History: Using tools like a vehicle history report can be a great way to avoid title washing. With these reports, you can see what previous titles or brands a vehicle had: if a car that now has a clean title previously had a salvage, junk, reconstructed, or rebuilt title, talk to the seller. If they seem unwilling to provide information, it may be better to look for a car elsewhere.

- Get the Vehicle Inspected: While the titling authority may not notice previous damage, a trained automotive professional will. If possible, take a vehicle in for an inspection before purchase. Even if the car has been fixed up and retitled, an inspection can show those subtle signs of hidden damage which are often present in a used car scam and are nearly impossible to fully conceal.

- Contact the Insurance Company: If you plan to insure your car (which you should), you can contact your insurance company to ask them about the vehicle’s insurance record. While this information is not always available, your insurer may be able to tell you whether the car has even been declared a total loss or salvage.

How to Buy a Car Without Getting Scammed

Whether buying a car online or in person, gathering as much information as possible is the best way to avoid getting scammed. Identify the seller and get contact information before the money changes hands. If possible, meet them in a safe public place to see the car. Using tools like vehicle history reports and VIN decoders, you should also learn as much about a car as possible. These tools can provide important details about any available car, including its title history, accident history, and the number of previous owners. Using this info, you can confirm any claims a seller makes and spot a used car scam before making a purchase.

FREE Vehicle Search

- Accidents

- Problem Checks

- Title Records

- Recalls

- Values

- Specs

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-