Latest Articles

Choosing the Best Cars for Seniors Based on Comfort, Safety, and Ease of Use

- -

- -

- -

- -

By Patrick Peterson

Published January 30, 2026

How Much Does It Cost to Tint Car Windows? Pricing, Types, and What Affects the Cost

- -

- -

- -

- -

Published January 28, 2026

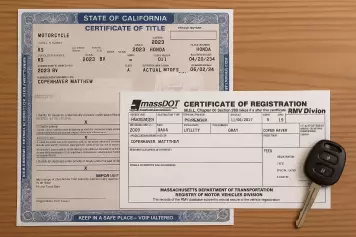

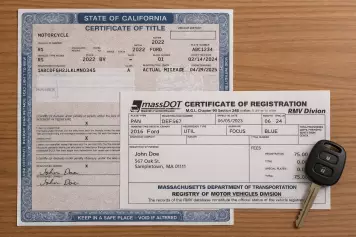

Difference Between Car Title and Registration

- -

- -

- -

- -

By Patrick Peterson

Published January 28, 2026

Featured Articles

Why Do Police Touch the Back Of Your Car When They Pull You Over?

- -

- -

- -

- -

By Adam Szafranski

Published March 17, 2023

Will My Car Insurance Rates Go up After a No-Fault Accident?

- -

- -

- -

- -

By Adam Szafranski

Published November 17, 2021

FREE Vehicle Search

-

InfoPay, Inc. (dba GoodCar) is an Approved NMVTIS Data Provider

-

-

![Best Sites to Check a Car’s History [2025 Review]](https://media.infopay.net/thumbnails/K8lMeG2QLjE46LPqZlmoi6SunKKdT5qvlaRZk6e1-w356.webp)